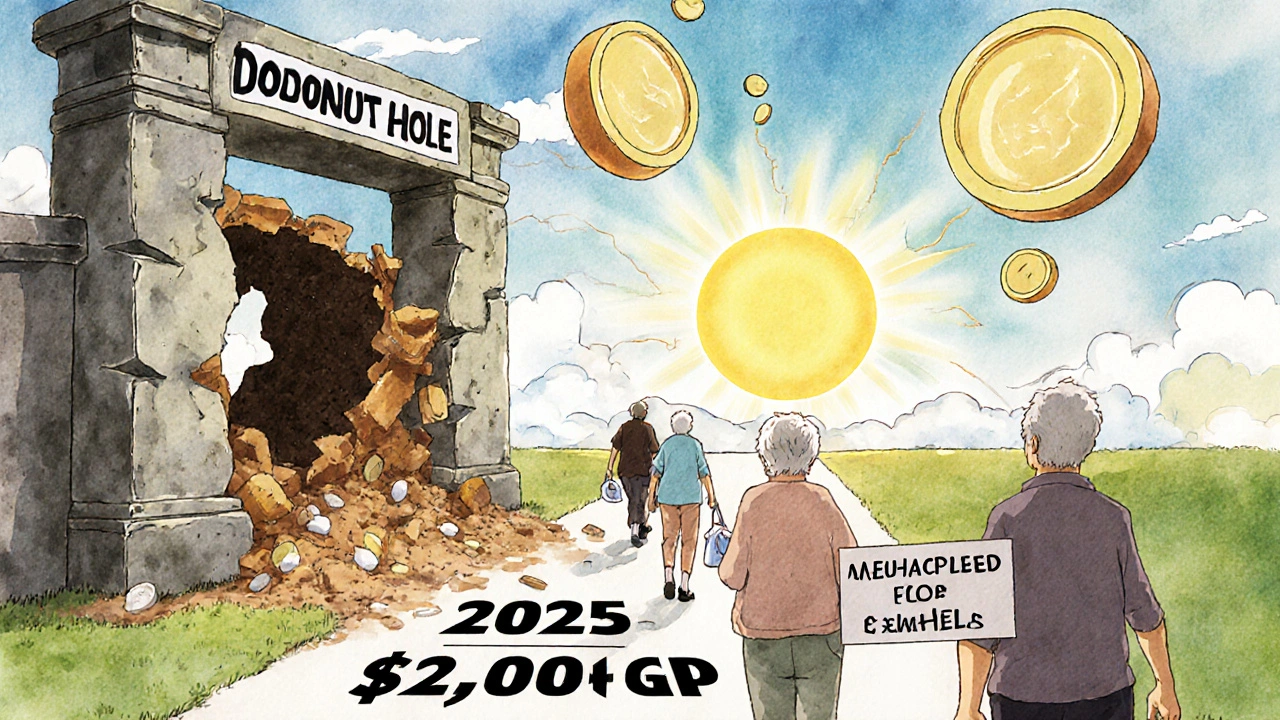

By the end of 2024, millions of Medicare beneficiaries will face a final, confusing year of the donut hole-a coverage gap where out-of-pocket drug costs spike after you and your plan spend a certain amount. But here’s the good news: starting January 1, 2025, the donut hole disappears entirely. A new $2,000 annual cap on out-of-pocket spending for prescription drugs kicks in, and you’ll pay nothing after that. If you’re taking expensive medications right now, this transition matters-big time.

What the Donut Hole Actually Means in 2024

The donut hole isn’t a mystery. It’s a phase in Medicare Part D where you pay more for your drugs after your plan’s initial coverage limit is reached. In 2024, that limit is $5,030 in total drug costs (what you and your plan have paid together). Once you hit that number, you enter the coverage gap. For brand-name drugs, you pay 25% of the cost. For generics, you pay 25% too. But here’s the twist: the manufacturer gives a 70% discount on brand-name drugs, and that discount counts toward getting you out of the gap. Generics don’t get that discount, so if you’re on generics, it takes much longer-and more money-to reach catastrophic coverage.For example, if you take Humira or Repatha, you’re paying 25% of the full price, but the manufacturer’s 70% discount is applied behind the scenes. That discount helps you climb toward the $8,000 threshold that triggers catastrophic coverage. But if you’re on a generic blood pressure pill, you’re paying 25% with no discount, so you’re spending more of your own cash just to get out of the gap.

Why the Donut Hole Is Vanishing in 2025

The Inflation Reduction Act of 2022 didn’t just tweak the system-it rebuilt it. Starting January 1, 2025, there’s no more donut hole. Instead, there are three clear phases:- Deductible phase: You pay up to $590 before your plan starts helping.

- Initial coverage phase: Your plan pays most of the cost until you’ve spent $2,000 out of pocket.

- Catastrophic coverage phase: Once you hit $2,000, you pay nothing for covered drugs for the rest of the year.

This change means if your total out-of-pocket spending hits $2,000 in 2025, your medication is free for the rest of the year. No more guessing. No more choosing between pills and groceries. This is a massive shift. In 2024, beneficiaries who reached the donut hole spent an average of $7,050 before hitting catastrophic coverage. In 2025? It’s $2,000-no more, no less.

Who Gets Hit Hardest by the Donut Hole Right Now

You’re most at risk if you take one or more expensive brand-name drugs. Think biologics for rheumatoid arthritis, multiple sclerosis, or cancer. Humira, Enbrel, Revlimid, and similar drugs can cost $1,000-$1,500 per month. Even with the 70% manufacturer discount, you’re still paying 25% of that-$250-$375 per month-just to stay in the gap.According to Kaiser Family Foundation data, 19% of Medicare Part D enrollees reached the coverage gap in 2022. Of those, 68% said they skipped doses, split pills, or delayed refills because of cost. One Reddit user shared how a client with rheumatoid arthritis was paying $1,200 a month for Humira during the gap. That’s $14,400 a year before the discount. Even with the 70% off, the beneficiary still pays $3,600 out of pocket-just for one drug.

People on generics aren’t off the hook. If you take multiple generic medications-say, for diabetes, high blood pressure, and cholesterol-you can still hit the $5,030 initial coverage limit. And without manufacturer discounts, you’re paying 25% of every dollar until you reach $8,000 in total spending. That could mean $6,000+ of your own money before you get relief.

How to Save Money Before the Donut Hole Disappears

You don’t have to wait until 2025 to cut costs. Here’s what actually works right now:- Check your plan’s formulary. Your drug might be in a higher tier than you think. If your insulin is in Tier 3, you pay 25% coinsurance. If you switch to a plan where it’s Tier 2, you pay a flat $10 copay. Use the Medicare Plan Finder tool-it’s free and updated monthly.

- Switch to generics. If your doctor says it’s safe, switching from brand to generic can save you $1,200-$2,500 a year. For example, switching from brand-name Lipitor to atorvastatin saves $90/month.

- Use manufacturer assistance programs. Most big drugmakers have patient assistance programs. Amgen’s Repatha program cut one woman’s monthly cost from $560 to $5. Eli Lilly’s Humira program offers $0 copay for eligible patients. You don’t need to be poor-many programs have income limits up to $100,000 for individuals.

- Get 90-day supplies. Mail-order pharmacies often charge less per pill. A 90-day supply of metformin might cost $15 instead of $25 for a 30-day refill. That’s $120 saved a year on one drug.

- Apply for Extra Help. If your income is below $22,590 (individual) or $30,660 (couple), you qualify for the Low-Income Subsidy. It eliminates your deductible, lowers your copays, and removes the donut hole entirely. About 12.6 million people qualified in 2023-many didn’t even know they were eligible.

What to Do in Late 2024 to Prepare for 2025

The changes aren’t coming next year-they’re coming in just a few months. Here’s your checklist:- Read your Annual Notice of Change. Plans mailed these in September 2024. It tells you exactly how your drug costs will change in 2025. Don’t ignore it.

- Compare plans during Open Enrollment. Open Enrollment runs October 15-December 7. Use the Medicare Plan Finder. Filter by your exact medications. A plan that looks cheap might have high costs for your specific drugs.

- Know your 2024 out-of-pocket spending. Track every payment you make for prescriptions-from your wallet, your bank, your credit card. Add your plan’s payments too. That total gets you out of the gap. If you’re close to $5,030, you might want to delay buying non-essential meds until January.

- Call your pharmacy. Ask if your drug is covered under the manufacturer’s 2024 discount program. Some pharmacies automatically apply it. Others don’t. You need to ask.

What’s Changing for Manufacturers in 2025

The drug companies aren’t just sitting back. They’re adjusting. In 2024, they gave 70% discounts on brand-name drugs during the donut hole. Starting in 2025, they’ll pay 10% during initial coverage and 20% during catastrophic coverage. That’s less than before, but it doesn’t matter-because you’re not paying anything after $2,000. The discounts now go to the plan, not to you. The goal? Lower premiums. And guess what? CMS says the average Part D premium in 2025 will be $34.70-down 1.1% from 2024. That’s the opposite of what many feared.

Real Stories: What People Are Doing Right

A 72-year-old in Ohio takes three expensive drugs: one brand-name, two generics. In 2023, she spent $6,800 out of pocket before hitting catastrophic coverage. In 2024, she switched her brand-name drug to a generic alternative after her doctor approved it. Her out-of-pocket dropped to $2,100. She’s now under the $2,000 cap that kicks in next year. Another man in Florida was paying $1,000/month for a biologic. He applied for the manufacturer’s patient assistance program and got it approved. His cost dropped to $0. He didn’t even need to prove financial hardship-he just had to fill out the form. And a woman in Texas didn’t realize her plan covered a cheaper version of her insulin. She switched during Open Enrollment and saved $1,400 a year.What You Shouldn’t Do

Don’t skip your meds. Don’t split pills unless your doctor says it’s safe. Don’t assume your plan will automatically apply discounts. Don’t wait until you’re in the donut hole to look for help. And don’t think the $2,000 cap is a reason to ignore plan changes in 2025-it’s a reason to act now.Final Thoughts

The donut hole is ending. That’s huge. But until then, you still have to navigate it. The tools are there: manufacturer programs, generic switches, Extra Help, 90-day fills, and plan comparisons. You don’t need to be an expert-you just need to take one step. Check your formulary. Call your pharmacy. Apply for assistance. Talk to your doctor. The system is complex, but you’re not alone. Millions are doing the same thing. And in 2025, you’ll finally have a clear, simple rule: pay $2,000, then your meds are free.What is the Medicare Part D donut hole in 2024?

The Medicare Part D donut hole is the coverage gap that starts after you and your plan have spent $5,030 on covered drugs in 2024. During this phase, you pay 25% of the cost for both brand-name and generic drugs, but only brand-name drugs get a 70% manufacturer discount that counts toward getting you out of the gap. You enter catastrophic coverage after spending $8,000 total out of pocket.

Will the donut hole still exist in 2025?

No. Starting January 1, 2025, the donut hole is eliminated. Instead, Medicare Part D will have a $2,000 annual out-of-pocket cap on prescription drugs. Once you hit that amount, you pay $0 for covered medications for the rest of the year.

How can I lower my drug costs during the coverage gap?

Switch to generic versions of your drugs if your doctor approves it. Use manufacturer patient assistance programs-many offer $0 or low-cost options. Get 90-day supplies through mail-order pharmacies. Apply for Extra Help (Low-Income Subsidy) if your income qualifies. And always compare plans using the Medicare Plan Finder tool.

Do manufacturer discounts count toward getting out of the donut hole?

Yes, but only for brand-name drugs. The 70% discount the manufacturer gives counts toward your out-of-pocket spending and helps you reach the $8,000 catastrophic coverage threshold. Generic drugs don’t get manufacturer discounts, so you pay the full 25% out of pocket without any help.

What is Extra Help and how do I qualify?

Extra Help (Low-Income Subsidy) is a federal program that reduces your Medicare Part D costs, including premiums, deductibles, and copays. It also eliminates the coverage gap entirely. In 2024, you qualify if your income is below $22,590 (individual) or $30,660 (couple), and your resources are under $16,920 (individual) or $33,840 (couple). Apply through Social Security or your state Medicaid office.

Should I change my Medicare plan in 2025?

Yes. Even though the donut hole is gone, plan designs change every year. The $2,000 cap doesn’t mean all plans are equal. Some still have higher premiums or different formularies. Use the Medicare Plan Finder during Open Enrollment (October 15-December 7) to compare plans based on your exact medications. The plan that was cheapest last year might not be the best in 2025.

Reema Al-Zaheri

November 19, 2025 AT 22:20While the $2,000 cap is a monumental improvement, the real issue remains: formularies are still opaque, and pharmacies don’t always apply manufacturer discounts automatically. I’ve seen patients pay full price for Humira for months because the pharmacy didn’t trigger the rebate-despite the drug being on the plan’s list. Always request a printout of your year-to-date out-of-pocket spending from your plan. It’s not optional. It’s essential.

James Ó Nuanáin

November 20, 2025 AT 15:55One must observe, with considerable bemusement, the sheer naivety of those who believe this change will not precipitate a surge in pharmaceutical pricing. The manufacturer discounts are being shifted from the beneficiary to the plan-thereby enabling insurers to reduce premiums while simultaneously inflating list prices. This is not reform; it is financial sleight-of-hand, dressed in the garb of compassion. The British NHS system, for all its flaws, at least maintains price controls. Here? We are merely rearranging deck chairs on the Titanic.

Nick Lesieur

November 20, 2025 AT 23:48lol so now i just pay $2000 and then its free? cool. guess i’ll just wait til jan and then buy all my meds at once. also my pharmacy still charges me $100 for metformin. whoops. 😅

Angela Gutschwager

November 21, 2025 AT 18:30My mom switched to a generic statin and saved $800/year. She didn’t even tell her doctor until she got the bill. Now she’s asking for generics on everything. Smart move.

Andy Feltus

November 23, 2025 AT 12:51It’s fascinating how we’ve turned healthcare into a puzzle where the rules change every year and the pieces are hidden under layers of corporate jargon. The donut hole was a failure of policy design-but the $2,000 cap isn’t a solution, it’s a concession. We’re not fixing the system; we’re just lowering the floor so fewer people fall through. The real question isn’t how to navigate the gap-it’s why we let the gap exist in the first place.

Zac Gray

November 24, 2025 AT 19:46For anyone still on brand-name biologics: don’t wait until December to check your manufacturer’s patient assistance program. I helped a friend apply for the Enbrel program in August-approved in 11 days, $0 copay. They didn’t even need to submit tax returns. Just a signed form and a prescription. The system isn’t broken-it’s just buried under bureaucracy. Dig a little. It’s worth it. Also, call your pharmacy every month. They’re not always proactive.

Steve and Charlie Maidment

November 26, 2025 AT 08:37Why are we still talking about this like it’s new? I’ve been in the donut hole since 2018. I’ve split pills, skipped doses, and once paid $1,400 for a single month’s supply of my RA med. The $2,000 cap is nice, but it’s not a miracle. My premiums went up 18% this year. I still pay more for my meds than my rent. And now they’re going to raise premiums again because ‘manufacturers are paying less.’ So who’s really winning here? The insurance CEOs? The stockholders? Not me.

Chuck Coffer

November 27, 2025 AT 03:25Wow. So now the government is just paying for our drugs? Next they’ll hand out free insulin with your Social Security check. What’s next? Free colonoscopies? Free oxygen? The entitlement culture is alive and well. And now it’s got a cap. Congrats.

Marjorie Antoniou

November 28, 2025 AT 23:47I know this sounds small, but if you’re on multiple generics, add up your monthly costs. You’d be surprised how fast $5,030 adds up. My neighbor takes 5 different generics for hypertension, diabetes, and cholesterol. She hit the gap in May. She didn’t realize until her card got declined at the pharmacy. She cried in the parking lot. Don’t wait for the bill. Track it. You’re not alone.

Andrew Baggley

November 29, 2025 AT 14:52Let’s celebrate this. The $2,000 cap is the most meaningful change to Medicare Part D in a decade. It doesn’t fix everything, but it removes the fear of choosing between insulin and groceries. That’s huge. If you’re reading this and you’re worried about costs-take one step today. Check your formulary. Call your pharmacy. Apply for Extra Help. You don’t need to be an expert. You just need to care enough to try.

Frank Dahlmeyer

November 30, 2025 AT 00:08Let me tell you something: I’m 68, retired, and I take three medications. In 2023, I spent $7,200 out of pocket. In 2024, I switched one brand to generic, enrolled in Extra Help, and got a 90-day supply through CVS mail-order. My out-of-pocket? $2,300. I’m going to hit the $2,000 cap by October. And guess what? I’m not just surviving-I’m thriving. The tools are there. The system is complex, yes. But it’s not impossible. You just have to be willing to fight for yourself. Don’t sit back. Don’t wait. Do the work. Your health depends on it.

Codie Wagers

December 1, 2025 AT 21:38It’s ironic. The very people who scream about ‘government overreach’ are now the ones who will benefit most from this policy. The donut hole was a market failure. The $2,000 cap is a correction. But the real tragedy? The people who need help the most-those without internet access, without family support, without the stamina to navigate bureaucracy-are the ones who will be left behind. This isn’t progress. It’s a bandage on a hemorrhage.

Paige Lund

December 2, 2025 AT 10:46So… I just pay $2,000 and then it’s free? Cool. I’ll just buy all my meds in January. 🤷♀️

Michael Salmon

December 3, 2025 AT 21:45Let’s be real: this cap only works if your drugs are covered. What if your cancer med isn’t on the formulary? What if your insurer decides to move it to Tier 5 next year? This system is still rigged. The cap is a distraction. The real problem? Drug companies set prices at whatever they want. The government doesn’t negotiate. And now they’re letting them off the hook with lower discounts. This isn’t reform. It’s a PR stunt.

Timothy Reed

December 5, 2025 AT 11:34Thank you for this comprehensive breakdown. The transition from the donut hole to the $2,000 cap is one of the most significant improvements to Medicare Part D in recent memory. For beneficiaries who are managing multiple chronic conditions, this change represents not just financial relief, but dignity. It is imperative, however, that outreach efforts be expanded to ensure that elderly, rural, and non-English-speaking populations understand how to access manufacturer programs and Extra Help. Knowledge is power-and in this case, it is life-saving.